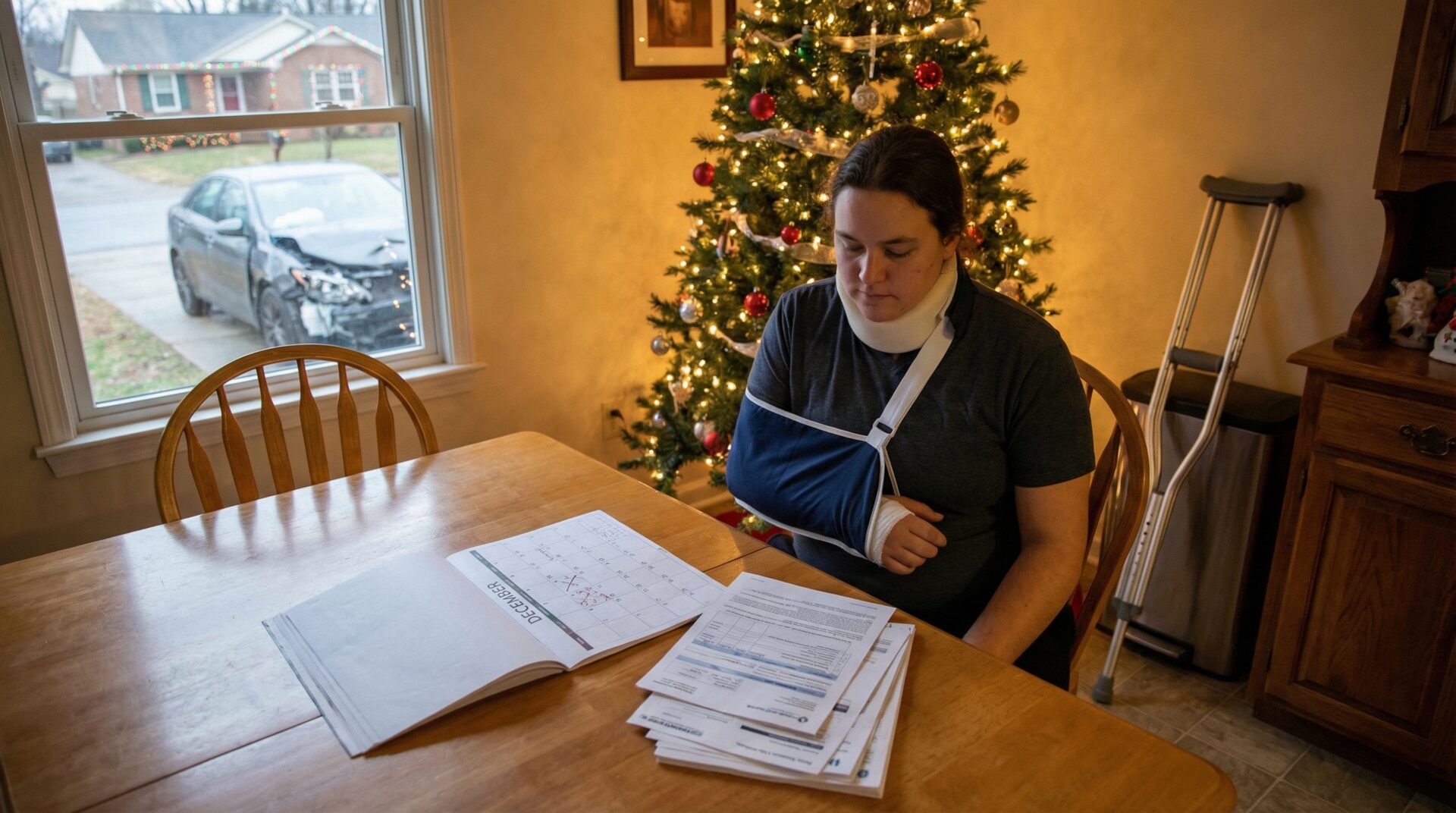

A serious crash during the holidays can turn your world upside down. You are juggling medical appointments, missed work, and holiday shopping, all while dealing with pain. It is tempting to put the legal paperwork aside until “after the New Year.”

This is a mistake.

In Tennessee, the clock ticks faster than in almost any other state. The steps you take (or miss) in the first 30 days after a holiday crash will determine whether your claim succeeds or fails.

The “Tennessee Timeline”: Why You Can’t Wait

Tennessee has one of the strictest deadlines in the country. Under Tennessee Code Annotated § 28-3-104, you generally have only one year from the date of the crash to file a lawsuit.

While a year sounds like a long time, the first 30 days are when the insurance company builds its defense against you. If you are passive during December, they are active.

The “Gap in Treatment” Trap

Insurance adjusters look for one specific thing during the holidays: a “Gap in Treatment.”

- The Scenario: You crash on December 23rd. You don’t go to the doctor because you don’t want to miss Christmas Eve dinner. You wait until January 3rd to visit a clinic.

- The Insurance Argument: They will argue that since you waited 10 days to see a doctor, your injuries were either (A) not caused by the crash, or (B) not serious enough to warrant compensation.

- The Fix: Seek medical attention immediately, even if it’s a holiday. Urgent Care centers are often open when primary care doctors are not.

A 30-Day Roadmap for Holiday Crash Victims

Do not let the chaos of the season distract you. Follow this timeline to protect your future.

Days 1–7: The “Evidence” Window

The first week is about securing proof before it disappears.

- Report the Crash: Ensure a report is filed with the Tennessee Highway Patrol or local police. You will need this for the Tennessee Department of Safety.

- Preserve the “Black Box”: Modern cars have Event Data Recorders (EDRs) that track speed and braking. If your car is totaled and towed to a salvage yard, this data can be destroyed in days.

- Silence is Golden: Notify your insurance company that a crash occurred, but do not give a recorded statement to the other driver’s insurer. They are trained to get you to admit fault.

Days 8–14: The “Diagnosis” Window

- Follow Doctor’s Orders: If you are prescribed physical therapy, go. Missing appointments to go holiday shopping is a red flag to adjusters.

- Document “Holiday Loss”: Did you have to sit out of the family football game because of back pain? Could you not pick up your grandchildren? Write this down. This is evidence of “Loss of Enjoyment of Life,” which is compensable in Tennessee.

Days 15–30: The “Evaluation” Window

- Review the Settlement Offer: By now, the adjuster may have offered you a “quick check” to close the case before the end of their fiscal year. Do not sign it.

- The “3.5x” Statistic: According to a study by the Insurance Research Council (IRC), injury victims who hire an attorney receive, on average, 3.5 times more money in settlements than those who handle it themselves. The insurance company knows this, which is why they want you to sign before you hire us.

3 Mistakes That Ruin Holiday Claims

1. The Social Media Trap

Insurance investigators watch social media. If you claim you have a debilitating back injury, but you post a photo on Facebook lifting a heavy turkey out of the oven or dancing at a New Year’s Eve party, your claim could be destroyed. Rule: Stay off social media regarding your accident and activities until your case is resolved.

2. Signing a “Blanket” Medical Release

Insurers will ask you to sign a form to “get your bills paid.” Often, these are broad authorizations that allow them to dig through your entire medical history—looking for old sports injuries from high school to blame for your current pain. Rule: Never sign a medical release without a lawyer reviewing it first.

3. Trusting the “Nice” Adjuster

The adjuster may send you a holiday card or sound very sympathetic on the phone. Remember: their job performance is based on saving the company money, not helping you.

We Are Here to Help (Even During the Holidays)

The insurance companies don’t take a break during the holidays, and neither do we. If you are injured, the first 30 days are vital.

Stillman & Friedland can intervene immediately to preserve the black box data, stop the harassing phone calls from adjusters, and ensure your medical treatment is documented correctly.

Don’t let a holiday crash ruin your new year.

Call us today at 615-244-2111 or reach out through our online contact form.

Because we care,

Stillman & Friedland